Negative credit score lenders have flexible lending needs. Which makes them an option for borrowers that have filed for bankruptcy.

At this stage, lenders will study your bankruptcies. Prior to moving ahead having a new mortgage, it can be crucial to be familiar with the details of which you filed for.

nine. What Influence Does Bankruptcy Have on Credit rating Scores or Employment? A bankruptcy filing could be mirrored on the credit history file for up to 10 a long time, regardless of the type or end result of your bankruptcy scenario. A bankruptcy filing can also have an affect on your capacity to borrow income, Even though the outcomes of such a filing differ considerably based on the creditor and the nature of the personal debt. Such as, an individual’s power to get refinancing on a home home loan might not be adversely influenced by a previous bankruptcy filing as long as payments on related obligations have remained latest.

After your bankruptcy is discharged, you’re normally in an improved economic posture than you ended up just before.

Swap leasing. This is essentially where you tackle some other person’s lease and just take above the payments from them. You have only to pay what’s left around the vehicle plus they get out of a personal loan that isn’t Performing for them for whichever reason.

It’s commonly an improved strategy to wait right up until read the article your Chapter seven bankruptcy is discharged to finance another vehicle. After you may have your discharge papers in hand, you are able to perform that has a subprime lender to your upcoming car or truck.

If you're looking for your automobile bank loan, it may be practical to get started on at nearby banks and credit unions, which have a tendency Read Full Article to get additional lenient lending requirements—particularly when you might have an present romance with an institution.

It is suggested that customers consult with with a professional economic advisor before taking over a consolidation mortgage.

You need to certainly be a member of the collaborating federal credit history union for a minimum this hyperlink of 30 days before you decide to’re suitable to get a payday substitute loan.

A reader miracles if she’ll get monetary savings by getting a new home loan, automobile financial loan, and credit cards. Or will she…

Shoppers can also utilize the no cost self-assistance sources on This web site or obtain the internet site means that look underneath “Shopper Financial debt Information”.

Reaffirmation agreement – Should you’re latest in your payments, you could possibly enter right into a reaffirmation agreement. This implies you published here go on paying with your car or truck underneath new or very similar conditions within your initial personal loan.

A bankruptcy can include a number of road blocks to your vehicle-funding knowledge, however it’s not normally a complete lifeless close. Getting a constant, trustworthy income and dealing on strengthening your click over here credit rating rating may help you protected an auto personal loan after bankruptcy.

Client Advisory: People are encouraged not to simply accept any unsolicited phone calls from firms who promise to solve costs. Moreover, in accordance with FTC polices, be sure to be recommended that NO upfront charges may very well be billed for resolution providers and NO fees in any way until eventually bills are productively minimized or solved.

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Bug Hall Then & Now!

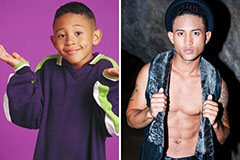

Bug Hall Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now!